north dakota sales tax on vehicles

North Dakota has a 5 statewide sales tax rate but also has 214 local tax jurisdictions including cities towns counties and special districts that. When you buy a car in North Dakota be sure to apply for a new registration within 5 days.

North Dakota Pip Insurance Bankrate

North Dakota has a statewide sales tax rate of 5 which has been in place since 1935.

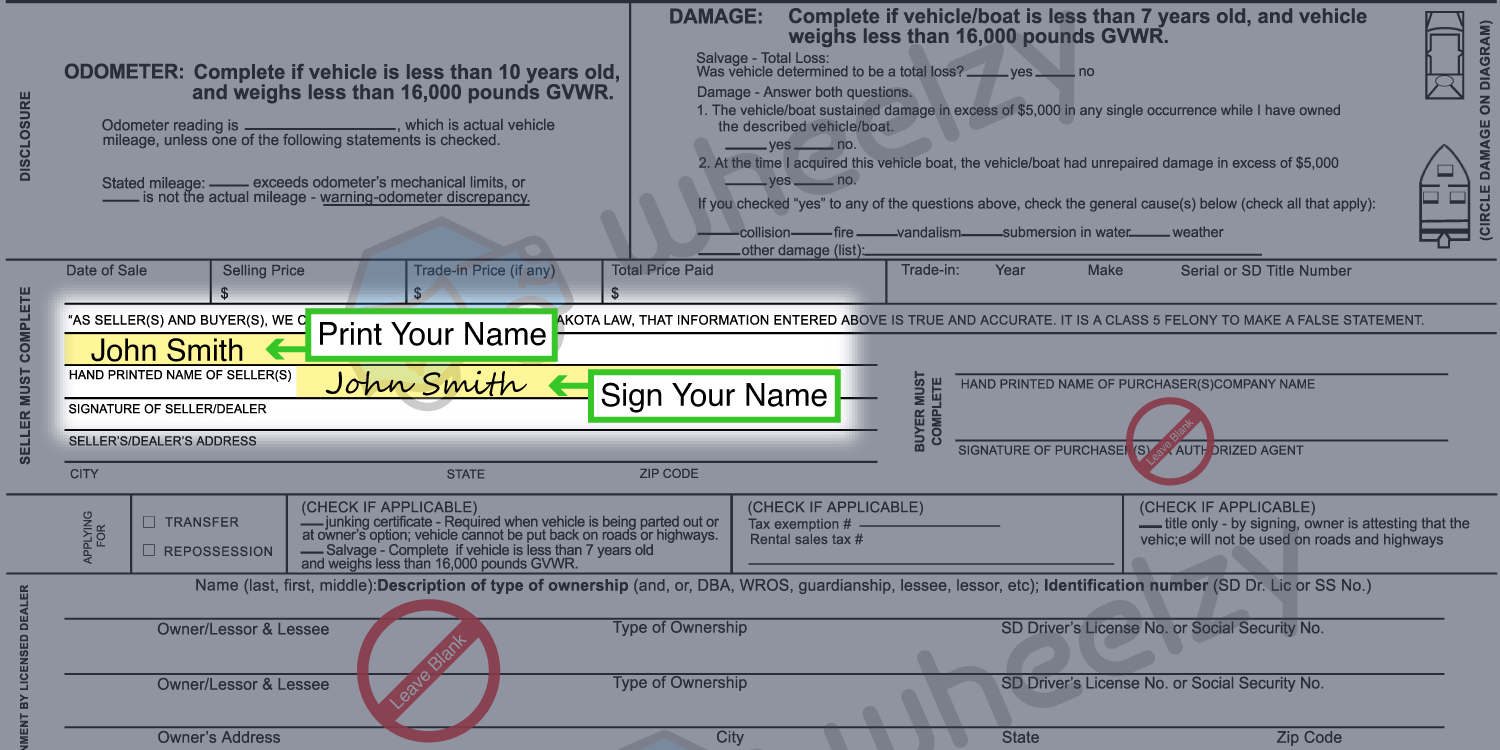

. Please contact 844-545-5640 for an appointment. The motor vehicle excise tax is in addition to motor vehicle. Completed showing selling price date of sale and current odometer reading which is required on all motor vehicles less than ten 10 years old.

To calculate registration fees online you must have the following information for your vehicle. That state we would require proof of tax paid to exempt you from North Dakota excise tax. Use exemption code 14 on the Application for Certificate of Title Registration of a Vehicle SFN 2872 North Dakota Department of Veterans Affairs - 4201 38th St S Suite 104 Fargo ND.

Although North Dakotas regular sales tax can range from. North Dakota imposes a sales tax on retail sales. The motor vehicle excise tax must be paid to the North Dakota.

The state sales tax on a car purchase in North Dakota is 5. The motor vehicle excise tax is in addition to any other tax provided for by law on the purchase price of motor vehicles. The sales tax is paid by the purchaser and collected by the seller.

Or the following vehicle information. Motor Vehicle Plates FAQ. The statewide sales tax in North Dakota is 5 and that rate applies to any vehicle purchased anywhere in the state.

You will also need to pay a 5 title transfer fee 5 sales tax and registration fees based on the. Certain items have different sales and use tax rates. Guidelines are listed below by tax type.

In the state of North Dakota sales tax is legally required to be collected from all tangible physical products being sold to a consumer. Municipal governments in North Dakota are also allowed to collect a local-option sales tax that ranges. North Dakota Title Number.

North Dakota levies a state sales tax rate of 5 percent for most retail sales. North Dakota sales tax is comprised of 2 parts. State Sales Tax.

The average local tax rate in North Dakota is. The 5 percent sales tax and the 3. Some examples of items that exempt from North Dakota.

The North Dakota 5 percent sales tax and 3 percent rental surcharge are imposed on rentals of motor vehicle for periods less than 30 daysin this state. IRS Trucking Tax Center. The state also allows cities and counties to levy an additional.

To search for a specific guideline use the search boxes to enter the name of the guideline select the tax type or include the guidelines. New local taxes and changes to. North Dakota allows credit for any excise tax paid on a motor vehicle in another state if that state allows a reciprocal credit.

Cities and counties may levy sales and use taxes as well as special taxes such as lodging taxes lodging and restaurant taxes and motor vehicle rental taxes. ND Motor Vehicle Sites. Selling a vehicle with North Dakota title.

North Dakota Office of State Tax Commissioner. However this does not include any potential local or county taxes. If the vehicle was purchased outside of the United States there is no tax reciprocity.

Vehicle Questions Answers.

Man Dies After Vehicle Pedestrian Collision In Mchenry North Dakota Grand Forks Herald Grand Forks East Grand Forks News Weather Sports

How To Sign Your Car Title In South Dakota Including Dmv Title Sample Picture

Printable South Dakota Sales Tax Exemption Certificates

What State Has No Sales Tax On Rvs Rvshare

Used Car Dealer In Finley North Dakota Visit Finley Motors Today

Buy A Used Car In Bowman North Dakota Visit Bowman Sales Service

What S The Car Sales Tax In Each State Find The Best Car Price

Vehicle Registration For Military Families Military Com

Buying A New Car In North Dakota Autobytel Com

Sales Taxes In The United States Wikipedia

S Dakota Counties Denied Sales Tax Power To Help Fund Money For Jails

North Dakota License Plate Hi Res Stock Photography And Images Alamy

Gun Laws In North Dakota Wikipedia

Cole County S Law Enforcement Sales Tax To Shrink In 2023 Without Further Action

Car Tax By State Usa Manual Car Sales Tax Calculator

Can I Register A Car In Another State

Form Fuel Voucher Motor Fuels Tax Payment Voucher Motor Vehicle Fuel